Calculator to pay off multiple credit cards

Consider a balance transfer APR offer but be alert. Pay off your balance on the new card as quickly as you can.

Simple Credit Card Payoff Calculator Updated Arrest Your Debt Paying Off Credit Cards Money Advice Payoff

Types of Credit Cards.

. While it may feel overwhelming try to focus on paying down the debt as soon as possible. To maintain good credit utilization budget wisely and aim to only use your credit cards on regular purchases you can pay off each month. With the option of adding extra payments.

These cards give the option of moving money to your current account which you can use to pay off your partners card. Promotional balance transfers offer lower interest rates. If you pay off your credit cards your utilization will go down to.

If youve multiple cards or debts always pay the most. Home financial debt payoff calculator. Tax payments over 100000 may come with special requirements and these.

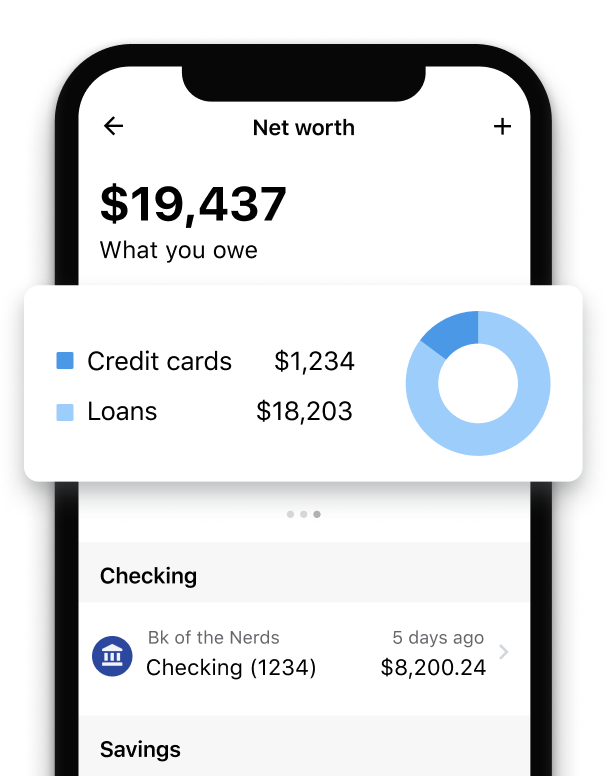

Free calculator for finding the best way to pay off multiple debts such as those related to credit cards auto loans or mortgages. For more information about or to do calculations involving paying off multiple credit cards please visit the Credit Cards Payoff Calculator. Many cards come with a balance transfer fee so read the fine print before you apply.

If youre already battling credit card debt a 0 introductory APR period from a balance transfer credit card could offer you a temporary respite from those interest charges. If you have multiple credit card balances paying off one is only the first step of your journey toward financial freedom. A Balance Transfer is when cardholders pay off one card by making a charge to another.

See the Money Saving Expert credit card interest calculator and 3 step plan Minimum repayments are designed to keep you in debt paying huge interest. See how much you could save. Credit card payoff calculator.

Youll then owe the amount on the new card. Use your credit cards only for transaction convenience never to extend your purchasing power. Avoid rewards credit cards for running a balance as variable APRs on these cards can exceed 25.

Here are strategies to help you pay off credit. Here are some key terms you need to know. Although undisciplined use of credit cards can result in significant debt when credit cards are used responsibly they can be an excellent payment method.

Youll pay a one-off fee to do it often higher than a balance transfer fee and while it will have a 0 period these are shorter than the top balance transfer offers. However some credit cards offer 0 APR balance transfers and have no balance transfer fees. But dont get discouraged if you cant afford to pay off your credit cards all at once.

Youre closer to being debt-free than you think. Just enter your current balance APR issuer and monthly payment to see how long it will take to pay off your balance and how much youll pay in interest. How much youd.

Consumer carries a credit card balance of nearly 6200 not an amount most can quickly come up with. This calculator utilizes the debt avalanche method considered the most cost-efficient payoff strategy from a financial. A credit card balance transfer moves the money you already owe to a new credit card offering a low or 0 interest rate for a set period.

There are a few additional details to note about paying your federal taxes with a credit card according to the IRS. On average Americans have four active credit cards with an estimated balance of 6194. Well even give you recommendations on cards that will help you save money.

Switch from asking how much youll have to pay monthly to how much youll have to pay overall a subtle but important shift in thinking. If you cant afford to pay the bill in full by the end of the month then dont buy it. Try to stay below 30 utilization to start but if possible an even.

If you got a card with a 0 APR offer try to pay it all off before the 0 APR period ends. In order to pay off 10000 in credit card debt within 36 months you need to pay 362 per month assuming an APR of 18. Look for these.

Credit cards seem like simple financial instruments but they arrive with pages of fine print that use terms more suited to a law office than a kitchen table. Doing so shows lenders youre a reliable borrower and dont run up large expenses you might not be able to pay off in a timely manner. By taking the proceeds of a personal loan to pay off credit card debt you can eliminate multiple monthly high-interest card.

Pay Off Another Credit Card. While you would incur 3039 in interest charges during that time you could avoid much of this extra cost and pay off your debt faster by using a 0 APR balance transfer credit card. And just made the minimum repayments it would take 28 years to pay it off and cost almost 4790 in interest.

This Chart Is For A Singular Credit Card The Chart In The Post Below Is For Multiple Cards Credit Card Debt Payoff Paying Off Credit Cards Secure Credit Card

Credit Card Debt Payoff Tracker Printable Credit Card Payoff Etsy Credit Card Debt Payoff Paying Off Credit Cards Credit Cards Debt

Debt Repayment Calculator Credit Karma

Credit Card Payoff Spreadsheet Paying Off Credit Cards Spreadsheet Budget Spreadsheet

Credit Card Payoff Calculator Pertaining To Best Free Credit Card Interest Calculator Excel T Credit Card Statement Paying Off Credit Cards Interest Calculator

Easy Excel Credit Card Payoff Calculator Debt Calculator Etsy Paying Off Credit Cards Credit Card Payoff Plan Credit Card Balance

Pin On Finances

Debt Snowball Payoff Calculator See Your Payoff Date Nerdwallet

Merchant Services Allow Businesses To Accept Credit And Debit Card Transactions In Person Or Onl Merchant Services Small Business Credit Cards Merchant Account

Pay Off Credit Cards Faster Using This Quick Tip Showit Blog Paying Off Credit Cards Secure Credit Card Credit Repair

Step By Step Guide On How To Get The Best Credit Card Machine Invoiceberry Blog Credit Card Machine Paying Off Credit Cards Best Credit Cards

Debt Payoff Tracker Template Etsy Credit Card Debt Relief Paying Off Credit Cards Credit Card Tracker

Credit Card Payoff Calculator Experian

The Only Way To Pay Off Credit Card Debt When You Are Broke Paying Off Credit Cards Credit Cards Debt Money Saving Plan

Pin On Budget And Finance

6 Ways To Pay Off 10000 In Credit Card Debt Credit Card Check Out How To Calculate Your Credit Card Debt Payoff Paying Off Credit Cards Credit Cards Debt

The 12 Debt Tips I Used To Pay Off Over 76 000 In 19 Months Paying Off Credit Cards Debt Free Debt Payoff Plan